Thriving Environment & Data

Menu

Financing Green Causes

As a company located in an island state that is home to 1,100 of our teammates, it is our responsibility to protect and care for our land and natural resources. We see the direct and societal benefits of having our own clean energy system and know how important it is to help our customers save on energy costs and reduce their impact on the environment.

In 2022, ASB originated more than 270 new Clean Energy Loans totaling $12 million. We also acquired a portfolio of residential clean energy loans from another lender, valued at $115 million as of December 31, 2022. These loans allowed homeowners to purchase and install their own photovoltaic systems, solar water heaters, solar air conditioning and battery backup and storage. We work closely with local contractors to make financing easy for consumers. We offer financing for green purposes, such as electric transport, solar energy, storage and largescale renewable energy systems.

We also financed over $65 million in commercial clean energy projects from 2010 to 2022, supporting a total of 21.30 MW in renewable energy capacity. From nonprofits to large commercial real estate and apartment buildings, we are equipped to help customers finance medium and large-scale clean energy improvements. The following are just a few examples:

GEMS

Click to learn more →

By partnering with the Hawaii Green Energy Market Securitization Program, ASB is able to provide customized financing options for commercial clients interested in clean energy improvements. Our tailored loan structures allow customers the time and flexibility they need to repay their outstanding loan balance, which means more local businesses can take advantage of energy efficiency opportunities.

Apartment and Multi-Family Owners’ Associations

Click to learn more →

We work with apartment associations and owners of multi-family dwellings to help bring energy efficiencies to buildings across the islands. While most of our projects have centered around solar installations, we help condo associations finance other improvements, such as energy efficient lighting, HVAC, building envelope and water heating projects.

Commercial Financing

Click to learn more →

Recent commercial financing includes clean energy loans for non-profit customers, schools and both leased and owned commercial properties where our customers operate their businesses.

We also have opportunities to participate in tax credit programs, such as New Markets Tax Credits (NMTC), to help fund renewable energy and other projects in disadvantaged communities. Through a Hawaii-based community development entity formed in partnership with the Oahu Economic Development Board, we helped deploy over $100 million in NMTCs and plan to apply for future allocations. These allocations help bring new investments, services and job creation to some of the most underserved, low-income communities in our state and include direct investment in renewable energy projects in support of our state’s clean energy transition.

Addressing Potential Risk from Severe Weather and Climate Change

Operating on an island chain, we know that we must plan for extreme weather and sea level change and prudently mitigate related risks. One of the key potential risks from climate change is the potential for sea-level rise to affect properties that secure our loans.

We regularly monitor our credit risk exposure in areas at risk of future sea-level rise. All new residential and commercial real estate loans must undergo an environmental due diligence review as part of the underwriting process, which analyzes whether the property is located in a floodplain, sensitive ecological area or on contaminated land. Owners of commercial and residential properties located within the Special Flood Hazard Area, as designated by the Federal Emergency Management Agency, must obtain flood insurance through the National Flood Insurance Program as a condition of obtaining a property loan. We also require mortgagors to obtain hazard and hurricane insurance on their residential properties.

Sustainable Buildings

Our ASB Campus enabled us to bring more than 650 teammates who were once spread out across five different office locations across Oahu together under one roof. This consolidation enhances our operational efficiency and reduces emissions by significantly cutting down on the amount of time and energy commuting to meetings across town at other ASB locations for meetings.

In designing our Campus, we wanted a building that was reflective of our commitment to care for our customers, teammates and community. We saw the construction as an opportunity to rethink how we do business and what efforts we could implement to reduce our impact on the environment. Our Campus features some of the latest green technologies, including solar panels, electric vehicle charging stations, self-tinting windows, responsive LED lighting, water bottle filling stations and reclaimed wood furniture. We also used this opportunity to evaluate our work processes and committed to being as paperless as possible.

Reducing Emissions from Commuting

Increasing Energy and Water Efficiency in Our Branches

As we build or renovate our new locations, we are incorporating LED light fixtures and signage, self-tinting windows and low-flow water fixtures as part of our commitment to be more environmentally friendly. For our existing branches, we have rolled out green initiatives and are retrofitting the facilities with sustainable features. These include installing LED light fixtures and low-flow water fixtures and implementing recycling programs. In addition to having a positive impact on the environment, these features reduce our energy and water use and positively impact our bottom line.

Climate Risk Strategy

Goverance and Risk Management

The board recognizes that climate change, as well as other ESG-related risks, could have a significant impact on ASB’s long-term value. As a result, the board has determined that all physical and transition risks associated with climate change should be identified and formally integrated into our existing governance structures.

We are proud that five independent board members have direct experience in climate change and environmental management issues. Over the past few years, the board has also enlisted the assistance of third party experts in climate change risk. This in-house and external expertise has enabled the board to have informed discussions on how climate change may potentially affect ASB’s financial risks, including credit, market, and liquidity, as well as operational, strategic, and reputational risks.

The board holds a quarterly review of ESG-related strategic matters and manages an annual review of company strategy and enterprise risk at board strategy retreats. Topics of focus include:

2022

Analysis of cross-sector decarbonization pathways for Hawaii to achieve climate objectives.

2021

Investments in decarbonization strategies, alignment with global climate ambitions, and development of utility’s climate targets and pathways to achieve net zero carbon emissions.

2020

Update on the integration of material ESG elements, including climate change into risk management and strategic planning.

2019

Deep dive on climate change risk and sea level rise, which included presentations by a leading climate risk analytics firm and discussion about climate-related risks and mitigation plans.

Members of our ASB Management Committee team, including our EVP of Enterprise Risk & Regulatory Relations, EVP & Chief Credit Officer and EVP & Chief Financial Officer, EVP & Chief Marketing and Product Officer, and EVP & Chief Administrative Officer, play a critical role in identifying, mitigating, managing and reporting climate-related risks. They report important insights to the board during quarterly board meetings and on an as-needed basis.

The board oversees climate-related and other risks through comprehensive and integrated Enterprise Risk Management (ERM) program. The board also reviews and provides feedback on the company’s ERM program for identifying, mitigating, managing and reporting climaterelated risks to ensure these processes are effective. Topics discussed by the board include business continuity, technology innovation and integration and potential implications for physical assets and financial assets such as the bank’s loan portfolio.

Strategy

Risks

Risks

Climate change is expected to increase the severity and frequency of hurricanes, flooding and droughts in Hawaii while leading to rising temperatures and sea level across our state. If not appropriately planned for and addressed, these physical climate change impacts could cause damage to (i) ASB’s facilities and equipment, which could impact operations and reliability, (ii) the properties that secure our residential and commercial loans, which could impact the value of that collateral and (iii) the state economy, which could affect the financial health of our customer base.

We’re focused on managing and mitigating physical risks to our operations from climate change and we are leaders in community planning initiatives to promote physical and economic resilience in our state.

- We consider and plan for physical risks related to climate change, such as the potential for business interruption due to severe weather. To promote resilience and continued customer service, our core processing is located on the U.S. mainland with backups in several different U.S. states. This geographic diversification supports our ability to serve our customers even in the event of severe storms, flooding or other acute events impacting Hawaii.

- We regularly monitor our credit exposure in areas at risk of sea-level rise and increased exposure to climate-related weather events. Our appraisal team performs property research to confirm flood zones and our underwriting decisions evaluate flood zone maps, which consider property location, topography and elevation. We require borrowers with property in a Special Flood Hazard Area, as defined by the Federal Emergency Management Agency (FEMA), to maintain sufficient flood insurance throughout the life of the loan. Should Special Flood Hazard Areas change due to sea-level rise, we may require affected borrowers to obtain flood insurance. We monitor leading indicators to assess how and when market valuations may reflect potential future climate change impacts and discuss such indicators and any mitigation recommendations with the ASB Risk Committee.

- Our success is linked to the strength of the local economy, community and environment of our state. Adverse climate-related changes in Hawaii could impact our state’s environmental and cultural assets and its appeal as a visitor destination and place to live. These conditions could negatively impact our business if they affect our state’s tourism sector, which is currently the largest driver of Hawaii’s economy, or decisions by Hawaii businesses and families to relocate out of state. Other conditions that could pose a threat to Hawaii include warmer temperatures; warmer oceans that place stress on coral reefs and sea life, which could potentially reduce the abundance and variety of marine life; and sea-level rise and coastal erosion, which could adversely impact our state’s beaches and near-shore infrastructure, homes and businesses.

In addition to physical risks, we must also be prepared for risks associated with transitioning to a low-carbon economy, including increased climate-related government regulations and enforcement actions, the cost of converting to low-carbon technologies, uncertainty in the market due to shifts in consumer preferences, and reputational impacts resulting from our response to climate change risks.

Opportunities

Opportunities

As with any challenge or issue, the threat of climate change presents an opportunity to innovate to better serve our customers, teammates and community, make our business more efficient and become better stewards of our environment and natural resources. For example, we:

- Finance customer investments in energy efficiency, renewable energy, storage, electric vehicles and resilience as businesses and consumers throughout Hawaii work to address climate change mitigation and adaptation.

- Participate in tax credit programs, such as New Markets Tax Credits (NMTC), to help fund renewable energy and other projects in disadvantaged communities.

- Deepen customer relationships by offering educational resources to help customers plan for climate change impacts, such as sea-level rise or increased severity of storms, to homes and businesses.

- Enhance the energy and water efficiency of our real estate footprint (reduced in recent years through office and branch consolidations) and incentivize employees to use low-carbon transportation options.

- Reduce reliance on the physical retail branch network, increasing resource efficiency as we upgrade facilities and transition to mobile-and technology-enabled “Anytime, Anywhere Banking.”

- Finance the development of sustainable, affordable and workforce housing; such housing can be equipped with features such as solar water heating, solar plus battery storage and efficient water and water reuse systems.

For more information about the risk and opportunity horizon over the short, medium and long-term, and an analysis of ASB’s strategy in different climate-related scenarios, please visit HEI’s 2022 ESG Report.

Greenhouse Gas (GHG) Emissions Inventory

Given how central climate impact is to our state and our strategies, we understand the importance of measuring and reporting on our GHG emissions. We completed our first detailed emissions inventory in 2022 and continue working with experienced advisors to calculate and disclose our emissions in line with global and industry standards. This year, we’ve built upon our initial inventory by expanding coverage of Scope 3 categories.

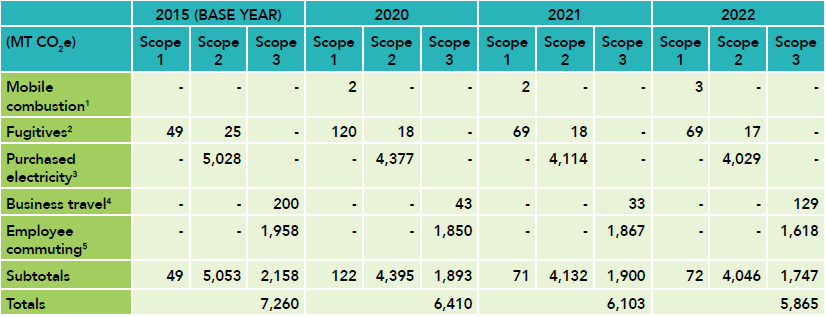

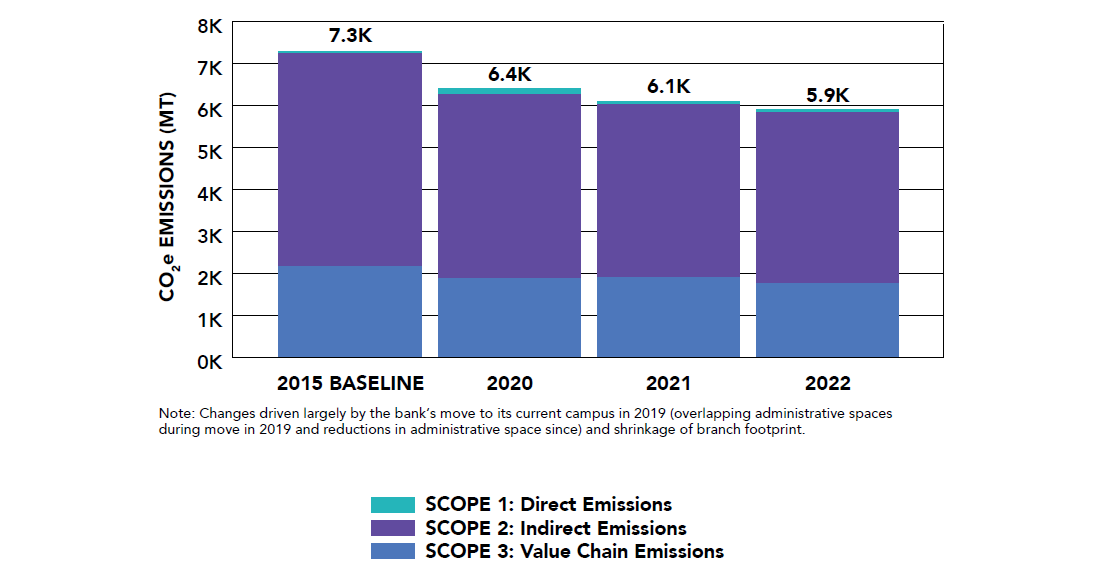

The GHG emissions inventory captures the types of emissions listed in the table below over the last three years (relative to a 2015 baseline, the earliest year for which we have a complete enterprise-wide inventory). Net GHG emissions in measured categories decreased 19.2% from 2015 to 2022, driven largely by our consolidation of office spaces and branches.

Direct Emissions

SCOPE 1

Click to learn more →

Direct emissions, including:

- Company vehicle fleet

- Fugitive emissions from

- company operations

Indirect Emissions

SCOPE 2

Click to learn more →

Indirect emissions, primarily:

- Purchased electricity for use in own operations

- Fugitive emissions from HVAC units in leased facilities

Value Chain Emissions

SCOPE 3

Click to learn more →

Value chain emissions, including:

- Business travel and employee commuting

Summary of our historical GHG emissions inventory and components

Note: Figures have been developed in partnership with an experienced GHG emissions advisor, and should be considered preliminary and subject to future verification. Certain totals for 2015, 2020, and 2021 have been revised slightly from previous disclosures to reflect considerations including: use of the Global Warming Potentials in the UN Intergovernmental Panel on Climate Change’s 4th Assessment Report consistent with regulatory reporting and addition of select Scope 3 categories.

1 Fuel consumption data was used to estimate CO2 emissions, vehicle mileage data was used to estimate CH4 and N2O emissions.

2 Associated emissions were calculated per Greenhouse Gas Protocol guidance, estimating an upper bound refrigerant leakage rate that is 10% of the total HVAC unit capacity. Office square footage was also used to estimate HVAC capacity. Scope 2 fugitive emissions include emissions from HVAC units not owned or controlled (generally leased facilities).

3Associated emissions were calculated per EPA guidance using office space electricity consumption and EPA region-specific emissions factors. Location-based method.

4Spend-based method in which business travel spend is used to estimate emissions.

5Data for 2021 and earlier is based on average (national) data on commuting patterns, adjusting for remote work percentages. 2022 data was calculated using Hawaii-specific commuting patterns. This Hawaii-specific data was derived by calculating estimated commute distances of 1,000+ employees, based on anonymized ZIP codes.

American Savings Bank GHG Inventory (MT CO2 E)

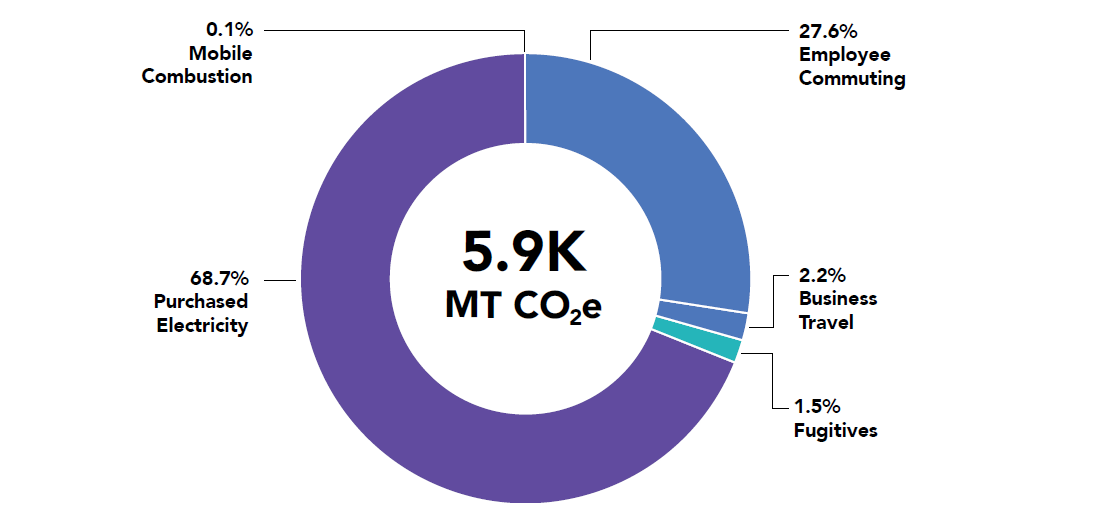

2022 ASB CO2e Emissions

Our Data

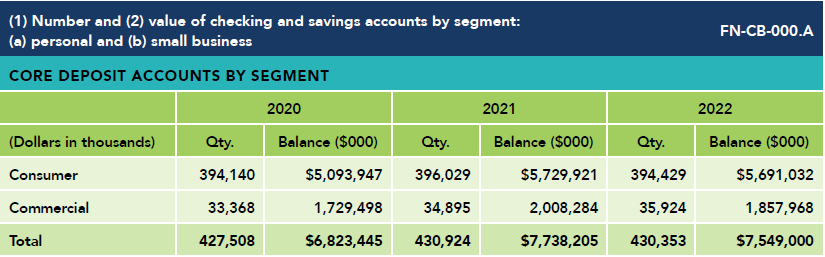

CORE DEPOSIT ACCOUNTS BY SEGMENT

As of December 31, 2022

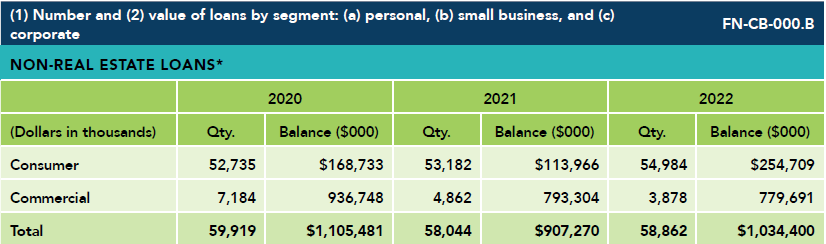

NON-REAL ESTATE LOANS*

As of December 31, 2022

In the two charts above “Consumer” refers to deposits and loans “primarily for personal, family or household purposes.” Within its general population of deposit accounts and loans, ASB does not separately categorize accounts as “small business” accounts. However, according to the U.S. Small Business Administration, 99.3% of Hawaii companies are considered small businesses. As such, we believe a significant proportion of companies that are our customers would be considered “small businesses.”

*Lines of credit that are not secured by real estate are included.

FN-CF-230a.1

(1) Number of data breaches, (2) percentage involving personally identifiable information (PII), (3) number of account holders affected

* See comment on page 95. ASB is in compliance with applicable requirements.

FN-CB-230a.2

Description of approach to identifying and addressing data security risks

FN-CF-230a.3

Description of approach to identifying and addressing data security risks

Two of the most significant cyberattack risks that ASB faces are e-fraud and loss of sensitive customer data. Please see page 24 of HEI’s 2022 Annual Report (10-K).

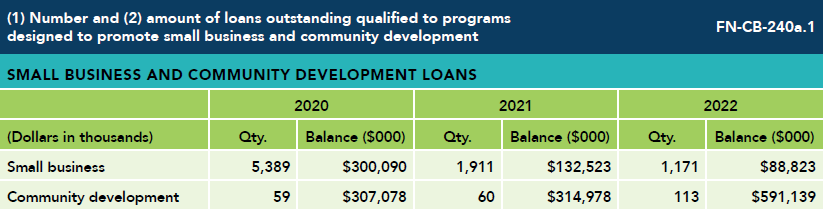

SMALL BUSINESS AND COMMUNITY DEVELOPMENT LOANS

As of December 31, 2022

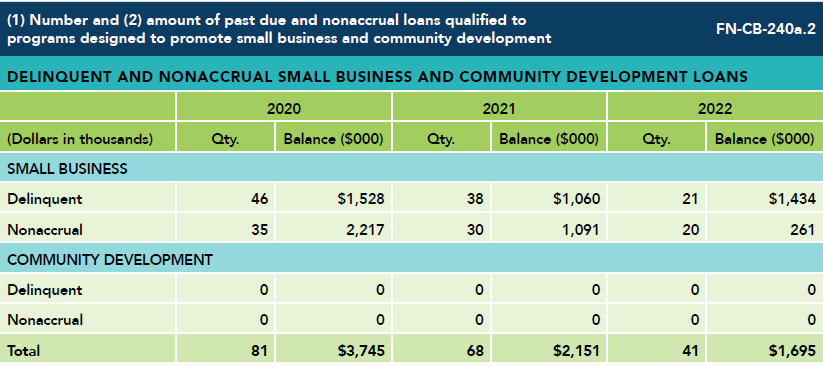

DELINQUENT AND NONACCRUAL SMALL BUSINESS AND COMMUNITY DEVELOPMENT LOANS

As of December 31, 2022

Number of no-cost retail checking accounts provided to previously unbanked or underbanked customers

ASB does not collect data on customers’ unbanked or underbanked status.

FN-CB-240a.4

Number of participants in financial literacy initiatives for unbanked, underbanked, or underserved customers

In early 2019, we launched an online financial checkup where individuals can answer a series of questions and get a basic financial health score. Based on their results, we make a recommendation on what area they could further explore. We also connect these individuals to bankers using an online appointment tool. In 2022, there were 585 financial checkups and 11,938 online appointments fulfilled.

On February 22, 2021, we launched an online financial education resource center. There, visitors can learn about Debt Management, Budgeting for Families, Credit Scores, Finance for Senior Caregivers and more. In 2022, 5,862 people accessed the center, with an average view time of 14 minutes and 14 seconds and an 18% conversion rate (measuring how many program users clicked through to a “custom moment”).

Customers also have the opportunity for financial education through our online financial calculators. In 2022, the calculators were viewed over 33,000 times.

The most popular calculator was “Calculate a Mortgage Payment” with 6,343 page views.

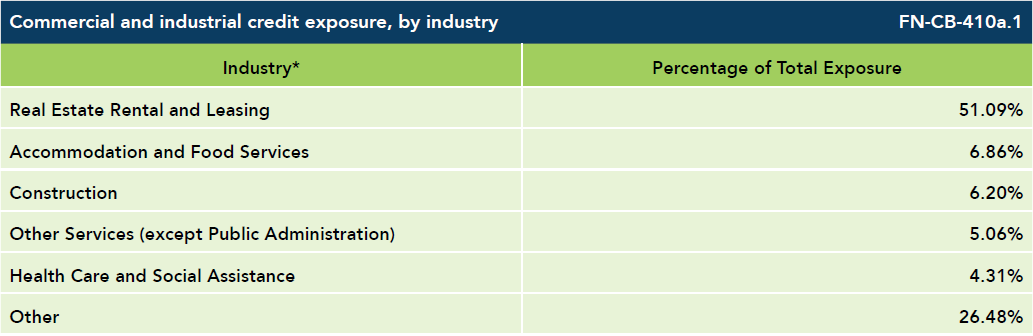

COMMERCIAL AND INDUSTRIAL CREDIT EXPOSURE, BY INDUSTRY

As of December 31, 2022

* The industry code is based on the North American Industry Classification System (NAICS) code that the customer provides. We have not reviewed the NAICS code for accuracy.

Description of approach to incorporation of environmental, social, and governance (ESG) factors in credit analysis

While we seek to increase access to financial services and support those businesses that make a positive impact in the community, we primarily evaluate our borrowers’ creditworthiness based on the business’s commitment to honor the obligations to ASB. During our due diligence process, if we learn of any negative ESG factors that do not align with our values, we may decline financing the business.

Our Commercial Credit Policy team analyzes the potential impacts that sea level rise and natural disasters can have on properties that secure our loans. Additionally, we monitor other known ESG risks that can affect the quality of collateral or our customers’ ability to pay. These credit risks are regularly reported to senior leadership and the board.

Based on these potential environmental impacts, we continuously analyze our underwriting policies, credit policy and risk mitigation efforts.

Total amount of monetary losses as a result of legal proceedings associated with fraud, insider trading, anti-trust, anti-competitive behavior, market manipulation, malpractice, or other related financial industry laws or regulations

Please see page 33 of HEI’s 2022 Annual Report (10-K). Description of whistleblower policies and procedures

Description of whistleblower policies and procedures

The Code of Conduct is a statement of the fundamental principles and key policies that govern our conduct; it is not intended to cover every applicable law or provide answers to every question that might arise. In many instances, the policies referenced in the Code of Conduct go beyond the requirements of the law.

Teammates who wish to report violations of ASB’s Code of Conduct may notify their managers, Human Resources, or anyone in the Legal Department. Teammates may also submit their concerns to EthicsPoint, a third-party reporting administrator. EthicsPoint permits teammates to make reports anonymously, through its website or hotline, and provides the content of the report to the appropriate individuals within the company to investigate. Teammates who make EthicsPoint reports also have the opportunity to answer questions anonymously and track the progress of their report through EthicsPoint’s website.

Speaking up can be extremely difficult for a number of reasons — one of which is a fear of retaliation. We believe that our teammates should feel comfortable raising their concerns. We do not tolerate retaliation against people who report suspected illegal conduct or violations of the Code of Conduct. Teammates who engage in retaliation are subject to discipline up to and including termination of employment.

All teammates receive regular in-person and computer-based training relating to identifying and reporting Code of Conduct violations and inappropriate conduct. Additionally, teammates must undergo annual training on compliance issues relevant to their job duties.

Global Systemically Important Bank (G-SIB) score, by category

ASB is not on the Financial Stability Board’s 2022 list of Global Systemically Important Banks, so it does not have a G-SIB score.

Description of approach to incorporation of results of mandatory and voluntary stress tests into capital adequacy planning, long-term corporate strategy, and other business activities

On an ongoing basis, we evaluate and address issues and activities that may pose potential risks to ASB, our teammates, customers, stakeholders and the community at large. This includes taking precautionary actions to anticipate, identify and manage risks related to our services and conducting regular stress tests.

With regard to stress testing, we analyze the impact of liquidity risk, interest rate risk, and credit risk on our financial position based on multiple adverse endemic and systemic scenarios. Our enterprise risk, finance and credit teams work in collaboration to perform this analysis at least on an annual basis. Additionally, we monitor risk indicators on a daily basis.

The Risk Committee of ASB’s Board of Directors assists with governance of ASB’s enterprise risk management program and provides a forum for detailed discussion and analysis of key issues and decisions designed to identify the significant risks potentially affecting ASB and to manage these risks. The enterprise risk management program focuses on various risk categories, including Credit (for loan, including related risk from sea level rise, and investment portfolios), Market (including interest rate sensitivity), Liquidity, Operations (including environmental, social, and governance), Strategic and Reputational.

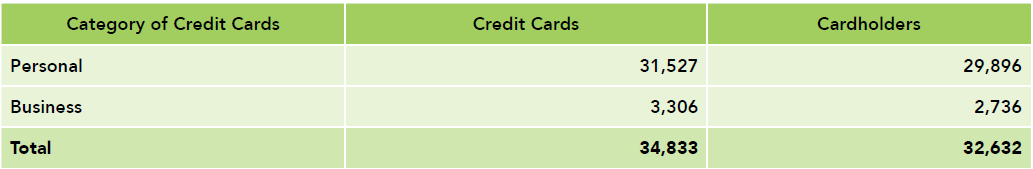

Number of unique consumers with an active (1) credit card account and (2) pre-paid debit card account

Number of (1) credit card accounts and (2) pre-paid debit card accounts

ASB does not issue any credit cards and does not offer any pre-paid debit cards. ASB’s branded credit cards are issued by Elan Financial Services, through a license from Visa U.S.A.

Number of account holders whose information is used for secondary purposes

Similar to other financial institutions, we collect and maintain data, primarily to allow us to originate and maintain deposit accounts, loans, investment accounts and other products and services that we provide. We may also use our customers’ data to provide us insight into products and services that would be beneficial for our customers, protect against fraud, security breaches and other wrongful conduct, and support the general operation of our business. We do not sell our customers’ data, nor do we plan to do so.

As a financial institution, we comply with the Gramm-Leach-Bliley Act, as implemented by Regulation P, and other federal, state and local laws and regulations. Our Privacy Notice can be found on our website at www.asbhawaii.com/security-fraud-privacy.

Total amount of monetary losses as a result of legal proceedings associated with customer privacy

Please see page 33 of HEI’s 2022 Annual Report (10-K).

Card-related fraud losses from (1) card-not- present fraud and (2) card-present and other fraud

Please see page 33 of HEI’s 2022 Annual Report (10-K).

Percentage of total remuneration for covered employees that is variable and linked to the amount of products and services sold

Eligible Branch Managers, Assistant Branch Managers and Personal Bankers who sell consumer loan products may receive incentive compensation of 10-15 basis points in their production of consumer loans, provided they meet the branch goal. These bankers must comply with all regulations and ethical rules to be eligible for incentive compensation. We may refuse to pay commissions to bankers who violate the law or ASB’s policies.

In 2022, only 6% of these teammates’ total compensation was variable and linked to the amount of products and services sold (e.g., referral fees, commissions, and bonuses).

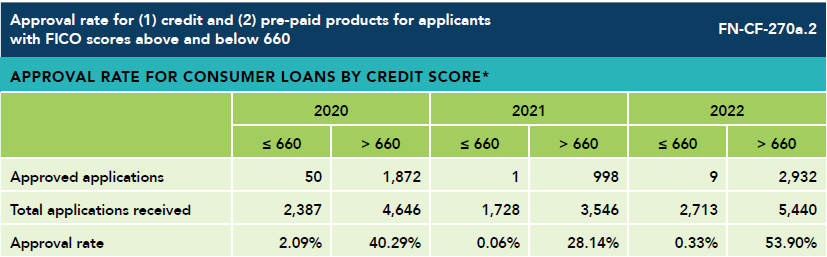

APPROVAL RATE FOR CONSUMER LOANS BY CREDIT SCORE*

ASB does not sell pre-paid products.

*This year’s disclosure is based on the decision status date, whereas prior disclosures were based on the loan application date. We also changed the categorization of applications to (1) below or equal to 660 and (2) greater than 660.

(1) Average fees from add-on products, (2) average APR, (3) average age of accounts, (4) average number of trade lines, and (5) average annual fees for pre-paid products, for customers with FICO scores above and below 660.

We offer various consumer loan products with a range of interest rates. As of December 31, 2022, the average interest rate for all of our consumer loan accounts was 7.72% and the average age was 1.1 years.

(1) Number of complaints filed with the Consumer Financial Protection Bureau (CFPB), (2) percentage with monetary or non-monetary relief, (3) percentage disputed by consumer, (4) percentage that resulted in investigation by the CFPB

See comment on page 95. ASB is in compliance with applicable requirements.

Total amount of monetary losses as a result of legal proceedings associated with selling and servicing of products

Please see page 33 of HEI’s 2022 Annual Report (10-K).

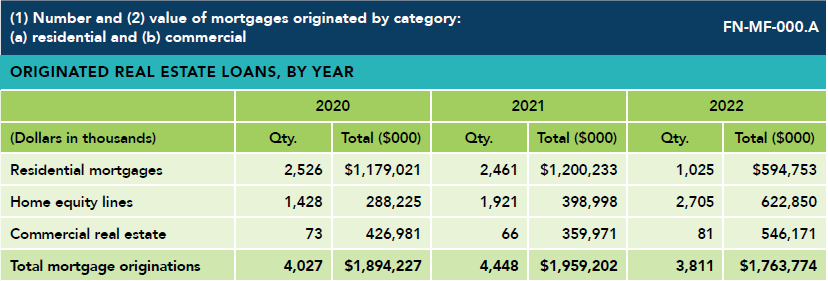

ORIGINATED REAL ESTATE LOANS, BY YEAR

(1) Number and (2) value of mortgages purchased by category: (a) residential and (b) commercial

We did not purchase any new real estate loans in 2020, 2021, or 2022.

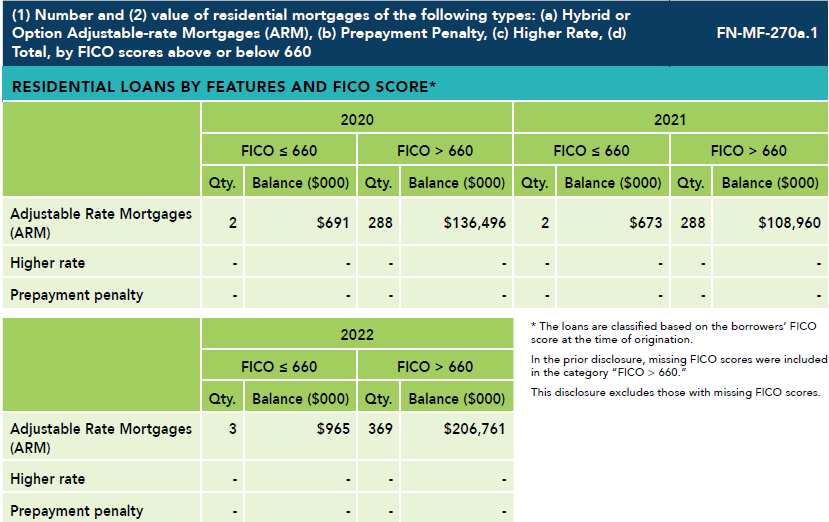

RESIDENTIAL LOANS BY FEATURES AND FICO SCORE*

As of December 31, 2022

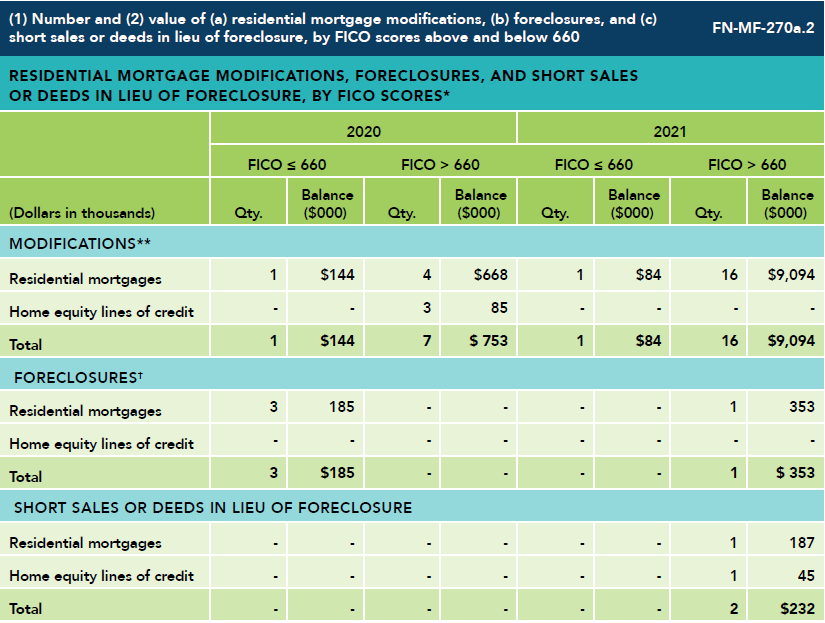

RESIDENTIAL MORTGAGE MODIFICATIONS, FORECLOSURES, AND SHORT SALES OR DEEDS IN LIEU OF FORECLOSURE, BY FICO SCORES*

* The loans are classified based on the borrowers’ FICO score at the time of origination.

** Loan modifications are limited to those requested by customers facing financial hardship.

† Foreclosures are limited to those where the borrower defaulted and a sale of the underlying property was forced.

Total amount of monetary losses as a result of legal proceedings associated with communications to customers or remuneration of loan originators

Please see page 33 of HEI’s 2022 Annual Report (10-K).

Description of remuneration structure of loan originators

Our residential loan officers receive a base wage, plus commissions of 40-90 basis points on originated residential mortgages. The actual rate of incentive compensation depends on whether the mortgages were externally sourced and the total monthly production of the loan officer.

Residential loan officers must comply with all regulations and ethical rules to be eligible for incentive compensation. We may refuse to pay commissions to loan officers who violate the law or ASB’s policies.

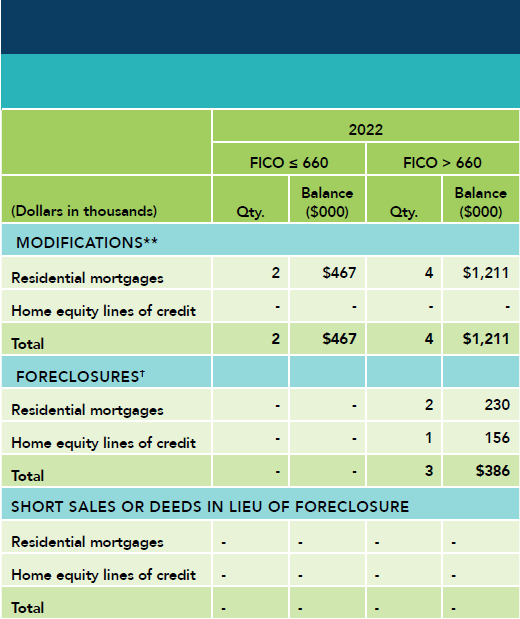

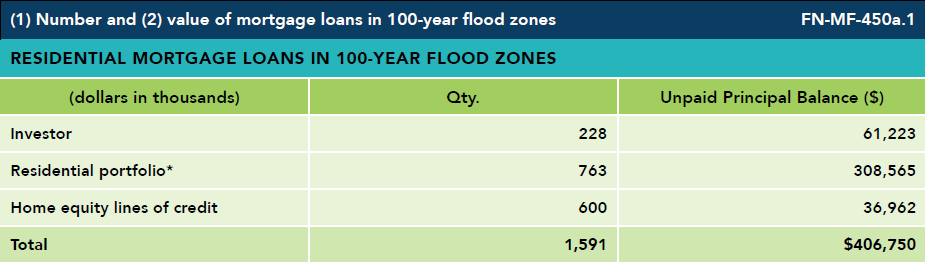

TOTAL ORIGINATED RESIDENTIAL LOANS* AND HOME EQUITY LINES OF CREDIT BY MINORITY AND CREDIT SCORE

* Land loans are excluded.

** Since last year’s ESG report, we modified some of the variables. 2021 figures are restated.

FN-MF-270b.2

Total amount of monetary losses as a result of legal proceedings associated with discriminatory mortgage lending

Please see page 33 of HEI’s 2022 Annual Report (10-K).

Description of policies and procedures for ensuring nondiscriminatory mortgage origination

As a covered financial institution, we comply with the Fair Housing Act and Equal Credit Opportunity Act, which prohibit discrimination in residential real estate credit-related transactions based on certain protected classes, such as race, color, national origin, religion, sex and marital or familial status. To prevent discriminatory lending practices, we regularly review our application processes and requirements, sales practices, policies and marketing material to ensure that all protected classes are fairly and equally treated. We also periodically review lending data to identify any policies or practices that may potentially affect protected consumers unfairly and unequally.

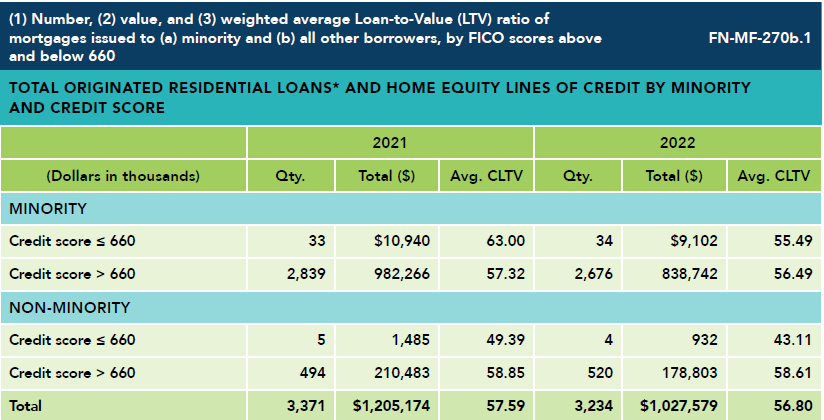

RESIDENTIAL MORTGAGE LOANS IN 100-YEAR FLOOD ZONES

As of December 31, 2022

* Residential Portfolio includes two loans held for sale (total unpaid principal balance of $0.8 million).

(1) Total expected loss (EL) and (2) Loss Given Default (LGD) attributable to mortgage loan default and delinquency due to weather-related natural catastrophes, by geographic region

The data is not available specific to weather-related natural catastrophes. ASB intends to expand its environmental risk analysis in the future.

Description of how climate change and other environmental risks are incorporated into mortgage origination and underwriting

Operating on an island chain, we know that we must prepare to adapt to the impacts of climate change and take steps to prudently mitigate related risks. Climate change may cause more frequent and intense weather-related natural catastrophes, such as hurricanes, storms, and flooding, and may result in sea level rise. We require all homeowners who live in a Special Flood Hazard Area, as defined by FEMA, to maintain sufficient flood insurance throughout the life of the loan. We also require all mortgages, with the exception of some home equity lines of credit, to secure hurricane and hazard insurance.

We regularly monitor our credit exposure in areas at risk of future sea-level rise. We perform property research to confirm flood zones, and our underwriting decisions consider factors such as the property location, topography and elevation.

GENERAL NOTE:

Based on ASB's products and loan portfolio, we have selected the Commercial Banks, Mortgage Finance and Consumer Finance Standards published by the Sustainability Accounting Standards Board (SASB).

While we have endeavored to provide fulsome responses to the SASB metrics, there are certain metrics for which we are not providing information due to the confidential nature of such information.